Home » NIFTY Option buy Algo – NIFTY Zoom

NIFTY Option Buy Algo

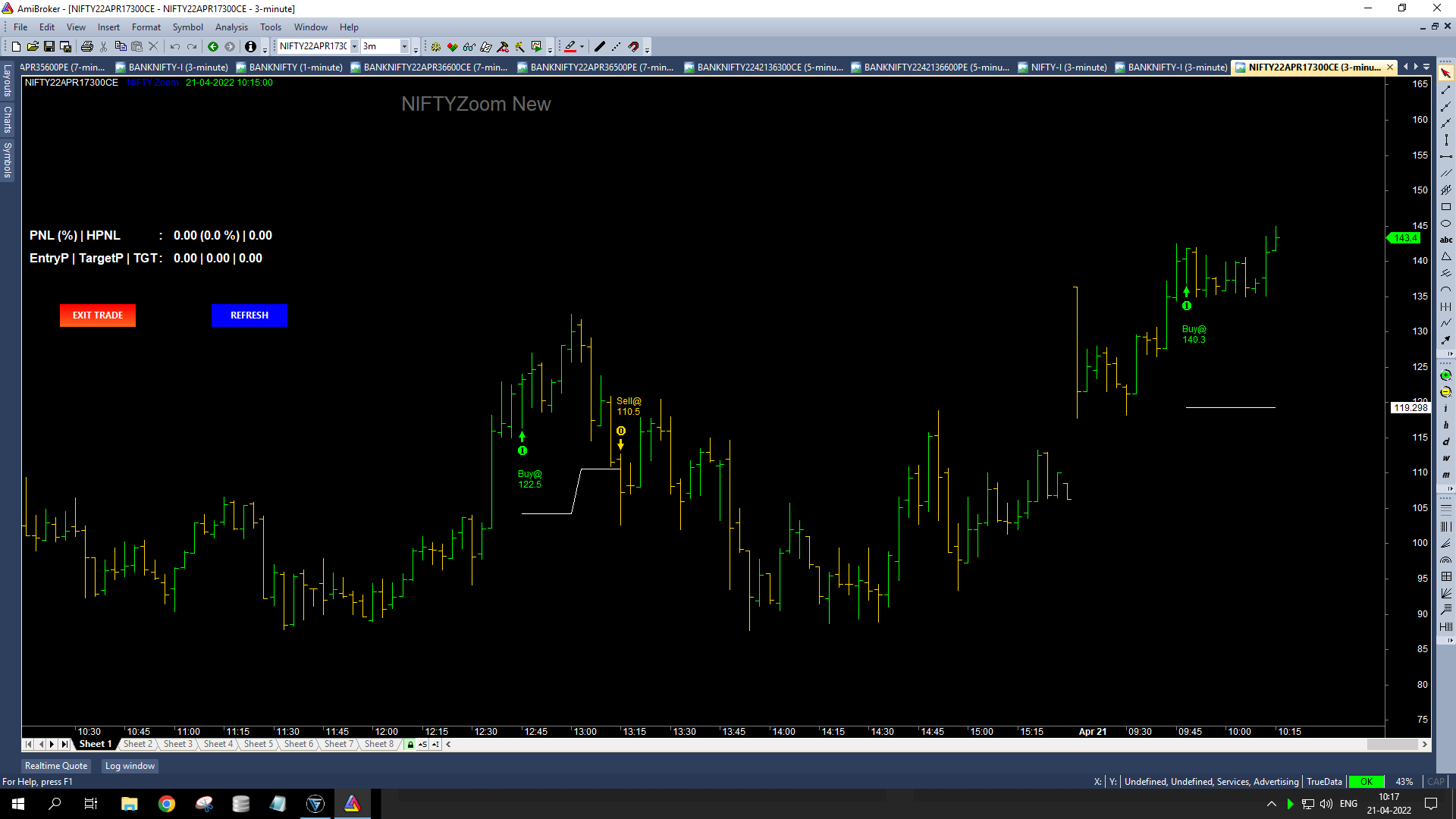

Developing NIFTY Option Buy Algo is most challenging when it comes to Intraday trading. As option buy goes against time decay or theta. Hence while developing NIFTY Option Algo we had to identify momentum. Thus let us see few important points on NIFTY option long strategy approach.

Points to Note:

- NIFTY option long algo bot doesn’t generate daily signals. As Theta goes against option buy, momentum support is very much needed.

- In fact there is a notion, option buy has potential of unlimited profit and option short can give unlimited loss.

- Contrary to the above, there is no unlimited profit or unlimited loss in either option buy algo or short algos for intraday.

- Clearly, option buy needs momentum support. Due to which, catching the momentum is the only key for NIFTY option buy Algo.

As this NIFTY option buy Algo strategy is developed considering NIFTY as underlying. Trade can be either on Call or Put options. In a day there shall be only one Call or one Put option trade, no multiple trade is planned in a day.

If you want to subscribe to this strategy then you can go to our marketplace and subscribe.

Our strategy have strict StopLoss and Target. Where the risk reward ratio is 1:4. considering 20% StopLoss and 80% Target (of the Premium price).

Daily Risk: Rs. 1,200 to 1,500/- is the maximum risk per day if trade goes wrong (Approximate).

Daily Reward: Up to Rs. 6,000/- is the maximum profit per day if target hits (Approximate)

Return on Investment

Firstly, the entry in this NIFTY option buy algo is generally at ATM (At the Money) option strike prices between Rs. 100 to 250. Consider the current lot size as 50.

As a result, the required margin against one lot of NIFTY option long algo bot is approximately Rs.15,000/-.

Bcktested result on historical data

As a rule, Please ensure you invest only your surplus fund, not your major source of living

Algo Trading Benefit

- Firstly there is no human intervention while generating Buy or Sell.

- Secondly, by avoiding emotions we can restrict our losses.

- And most importantly Orders can be placed to a broker terminal in a fully automated mode.

You may want to know

Required margin is Rs 15,000 (approximate), but we suggest to keep additional fund in your trading account to avoid frequent fund transfer for any loss.

This is an intraday strategy on NIFTY Options long only positions.

Please visit our Marketplace, then go to pricing plan. Choose the plan suit you the best and make the payment accordingly.

We don’t commit on profit per month, but based on last few month’s real trade this strategy can generate 5% return on investment average monthly basis.

Yes, this is a fully automated strategy. There is no manual intervention, no installation, no cloud, no Amibroker no data plan is required.

No, this strategy is not for one time purchase, its on subscription model or on profit share model based.

After payment, please send us an email or Whatsapp with your payment information. We shall enable your subscription for auto trade.

Yes. This strategy can not guarantee profit in every month. Our team keep working on the strategy to ensure our client’s loose less.

Moreover with continuous trade, you will always be in profit at the end of a quarter.