Home » Banknifty Future Algo Trading | Trishul Hedge

What is DTM Trishul Hedge

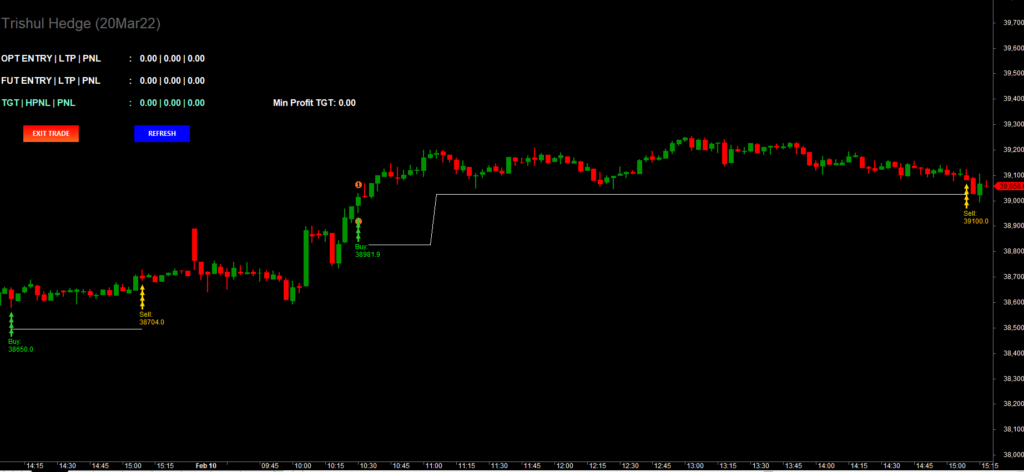

Unlike other option bots, Trishul is banknifty future algo BOT. In short it is Intraday algo bot on Banknifty Future with an option hedge leg.

In you are interested on banknifty algo trading, then Trishul can be the solution for you. Just like Trend following bots, it is designed keeping in mind the upward movement and downward movement of Banknifty indices. This is hedge Strategy bot. Because the bot buys Far OTM Call while Shorting Future, and simultaneously buys Put option while Buying Banknifty Future.

Because of this systematic, disciplined and strategical approach makes it possible to capture the price movement in different market conditions.

Although Banknifty future algotrading bot Trishul is currently available in our own Marketplace.

RISK AND REWARD

We believe in consistency, considering last 22 months data, we have 53% Winning. In this case, 24% comes from long positions and 31% comes from Short positions.

This banknifty algo trading Strategy bot has strict Stop Loss of 0.5%, which help us to limit our loss. It has a Target of 2.5%.

Risk: Rs. 3,500/- is the maximum risk per day if trade goes unfavorable (Approximate).

Reward: Rs. 18,000/- is the maximum profit per day if target hits (Approximate).

Data Analysis

The required margin against One Lot of Banknifty Future Algo bot Trishul is approximately Rs. 80,000/-. Over and above that we are also adding caution money of Rs. 30,000/- as safety. As a result the total investment comes to Rs. 1,10,000/-.

To know more about this Bot, please contact us

As a rule, Please ensure you invest only your surplus fund, not your major source of living

Briefly the benefit of intraday Banknifty algo bot

- Firstly there is no human intervention while generating Buy or Sell.

- Secondly, by avoiding emotions we can restrict our losses.

- And most importantly Orders can be placed to a broker terminal in a fully automated mode.

You may want to know

Firstly, required margin for Intraday Banknifty Algo bot is Rs 80,000 (approximate). However in addition to that we suggest/request to keep additional fund in your trading account.

In short, this is an intraday strategy based on Banknifty Future.

You can get the payment details in this Page

Although, we prefer not to commit on any profit ratios per month, but as per the last few month’s real trade history TRISHUL can generate 8% return on investment, monthly.

Of course, this Banknifty future Algo is a fully automated strategy bot.

For example, there is no manual intervention, no installation, no cloud, no Amibroker no data plan is required.

Furthermore, you can get this Intraday Banknifty algo bot in upfront subscription model or on profit share model based.

First and foremost, once the payment is done in our marketplace, the system shall automatically give you an option to select the bot.

Subsequently, you can choose the Bot and deploy for live trading.

To clarify, no strategy can guarantee profit every month. Intraday Banknifty algo bot Trishul is no exception.

It should be noted that our team keeps working on the strategy to ensure your funds safety.

Importantly, with regular trades your chances are surely better to be in profit.