Banknifty Weekly Option Short Algo Bot - CDOS

Unlike other positional strategies available, Banknifty continuous Option Short Algo CDOS is a Bot for Banknifty options positional algo Trader which is based on Banknifty Option short.

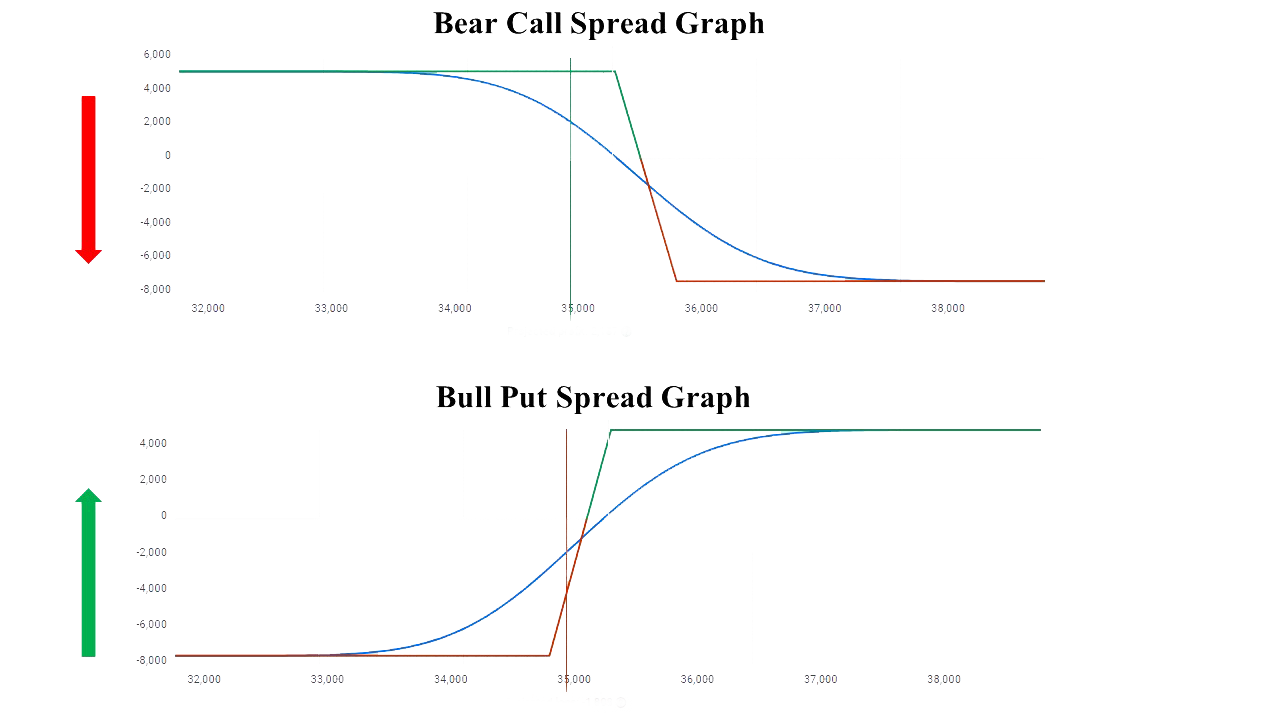

Banknifty CDOS, have neither any Target nor stoploss. This Banknifty Option swing trading algo bot is typically Bear Call spread or Bull Put spread which reverses its position based on the condition. Where based on signal, the bot shall either Short ITM Call and Buy OTM Call or Short ITM Put and buy OTM Put. If Banknifty gives downtrend, then the bot takes Bear Call Spread position and If Banknifty gives uptrend then the bot takes Bull Put Spread.

To begin with margin, it is approximately Rs. 40K – 50K or less .

Risk and Reward:

Compare to NIFTY, Banknifty is generally high volatile. As a result, this bot has a potential to give higher return during trending market condition. In summary it works well in trending market and high volatile market this bot shall give us good return. During choppy market condition this bot shall fail.

In order to know more about this Bot you can visit our Marketplace.

Required Investment

In this case, the Margin requirement for this strategy bot is Rs. 50,000/-

Importantly, in Banknifty CDOS Option Bull/Bear spread you can see the actual ROI based on actual trade data only.

Please ensure you invest only your surplus fund, not your major source of living

Robo Trading Benefit

- Firstly there is no Human intervention while generating Buy or Sell.

- Secondly, by Avoiding Emotions we can restrict our Losses.

- And, most importantly Order can be placed to a Broker terminal in a fully automated mode.

You may want to know

Firstly, required margin is Rs 50,000 (approximate), however in addition to that we suggest/request to keep additional fund in your trading account.

In short, this is a Banknifty options continuous shorting strategy bot which is positional in nature.

Although, we prefer not to commit on any profit ratios per month, but as per the last few month’s real trade history NIFTY SURYA can generate 5% return on investment, monthly.

You can get the payment details in this Page

Of course, this is a fully automated strategy.

For example, there is no manual intervention, no installation, no cloud, no Amibroker no data plan is required.

Furthermore, you can get this strategy in subscription model or on profit share model based.

First and foremost, once the payment is done in our marketplace, the system shall automatically give you an option to select the bot.

Subsequently, you can choose the Bot and deploy for live trading.

To clarify , no strategy can guarantee profit every month.

It should be noted that our team keeps working on the strategy to ensure your funds safety.

Importantly, with regular trades your chances are surely better to be in profit.