To understand what is OSCP oscillator and how to use this oscillator for better trade, please read below.

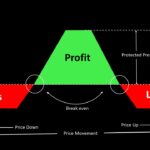

OSCP is an oscillator, which works exactly as two different EMA crossover. To understand its trend, you can plot two EMA lines on your price chart as shown below, and then draw OSCP oscillator on the bottom of the chart with same EMA combination. When EMA lines crosses each other in the price chart, the OSCP oscillator crosses ZERO line accordingly.

This helps a Trader to trade more accurately using OSCP instead of EMA crossover. There are different ways to use OSCP oscillator for early entry and early exit as well as avoid choppy areas which only EMA crossover can’t detect. The below image has both EMA crossover and OSCP plotted. EMA 9 and EMA 26 is plotted on the price candlestick chart, and at the bottom OSCP is plotted on 9 and 26 EMA. If we watch closely, then we can see whenever EMA 9 crosses above or below EMA 26, OSCP line crosses ZERO line upward or downward simultaneously.

Range to Oscilate

OSCP oscillates above Zero line and below zero line. Generally it goes up to 3 as overbought area and goes below -3 as oversold area. However the overbought and oversold zone can vary based on type of Stock and timeframe used. For intraday trade generally 0.5/0.9 to -0.5/-.09 can be the overbought and oversold range. The range may vary based on the volatility of the Stock.

Buy or Sell using OSCP

Now let us check how can we plan our Buy or Sell position based OSCP Oscillator. There are different ways to place a Buy order.

Entry Criteria: (Bullish)

- Buy at Oversold: We can Buy in Oversold, when OSCP crosses above -0.5/-0.9 mark

- Buy at Overbought: We can buy when OSCP is crossing our plotted overbought line to capture strong bullish trend.

- To avoid choppiness : We can buy when OSCP line crosses 0.1 mark.

Exit Criteria: (Bearish)

- Short at Overbought: When OSCP reaches overbought area and goes down below the overbought line, then place your Short.

- Short at oversold: To consider bearish trend, short when OSCP crosses from above oversold line to below oversold line downward.

- To avoid Choppiness: Short when OSCP goes below -0.1 level.

Please remember to select your own overbought and oversold lines based on script and timeframe you are trading. Similarly choose choppiness lines based on Stock’s volatility.