Nifty Index comprises top 50 Stocks of NSE among total 1600 stocks. These 50 stocks have the largest free float market capital among all. These Stocks are selected from 12 different sectors of Indian economy. IISL is India’s first specialized company focused upon the index as a core product, who manages NIFTY 50 Index. Nifty Futures and Options are most liquid, no scope of loosing money on impact cost.

- The NIFTY 50 Index represents about 65% of the free float market capitalization of the stocks listed on NSE

- The total traded value of NIFTY 50 index constituents almost 45% of the total trade in NSE

- Impact cost of the NIFTY 50 for a portfolio size of Rs.50 lakhs is 0.02%

- NIFTY 50 is ideal for derivatives trading.

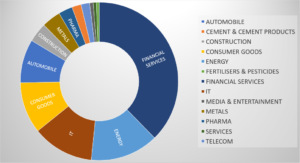

Let us see what are the sectors which forms NIFTY 50 Index and their weightage.

| Sector | Weightage |

| FINANCIAL SERVICES | 37.67% |

| ENERGY | 13.97% |

| IT | 12.59% |

| CONSUMER GOODS | 10.49% |

| AUTOMOBILE | 8.90% |

| CONSTRUCTION | 4.00% |

| METALS | 3.87% |

| PHARMA | 2.88% |

| CEMENT & CEMENT PRODUCTS | 1.89% |

| TELECOM | 1.77% |

| MEDIA & ENTERTAINMENT | 0.72% |

| SERVICES | 0.65% |

| FERTILISERS & PESTICIDES | 0.61% |

The above table and image elaborates the Weightage of different sectors in NIFTY 50 Index. The more weightage any sector have in Nifty 50 the more that sector will influence NIFTY 50’s movement based on the Sector’s movement.

Here is how NIFTY 50 grown over last 8 years, from 2010 till 2018. This graph will depict NIFTy-50’s journey from Rs.5000/- to Rs. 11,000/-

Be a part of NIFTY-50 further bull movement, we shall witness NIFTY-50 at Rs. 20,000/- on or before 2021.