This is going to be an interesting discussion, if you are new to option trading or have started learning about option strategies or if you are already trading options but want to know more about option strategies.

Here we are going to discuss about Iron Condor option strategy. This is my favorite Intraday and positional strategy, and I love this because it reduces my fund requirement to deploy the strategy drastically.

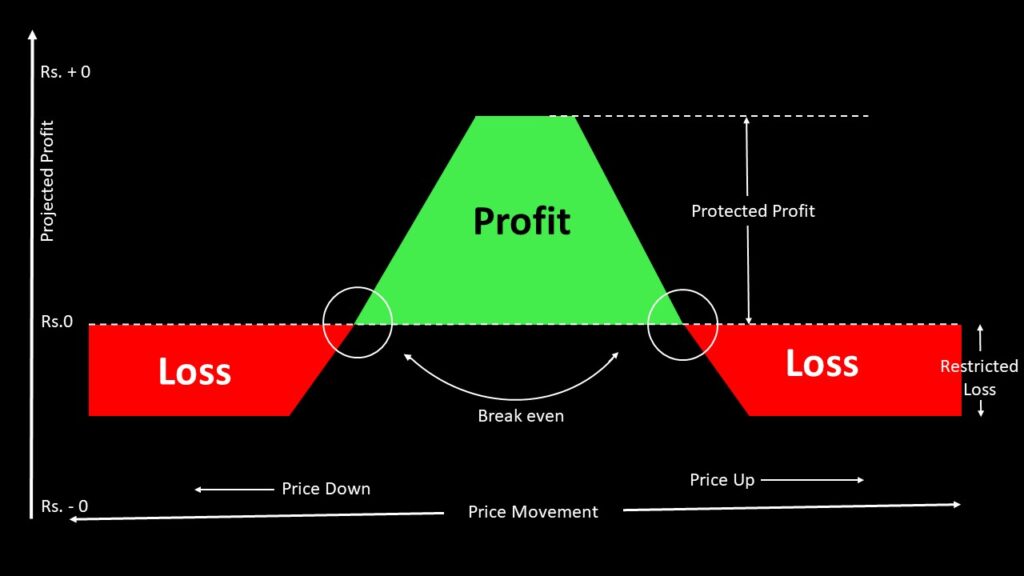

Why fund requirement is Less: Iron condor is a strategy where we short both OTM Call and Put options and buy further OTM call and put option to hedge the position. As we are taking hedge position, hence risk reduces for any unknown upward or downward movement. Low risk meaning less financial burden on Broker, hence broker can give us low margin as recommended by SEBI.

What is Hedge: If you are not aware about hedge, then hedge is very simple to understand. If you are driving your car without wearing seatbelt, then in case of any accident you may get hurt and if you are wearing seatbelt, meaning you are protected from any injury. it is similar to hedge in financial term. If you are buying any instrument with a hedge position, you are protecting your fund from any unknown risk.

How to design Iron Condor: To design iron condor, you need to do the following.

- Short OTM Call option

- Short OTM Put option

- Buy Further OTM Call option

- Buy Further OTM Put option

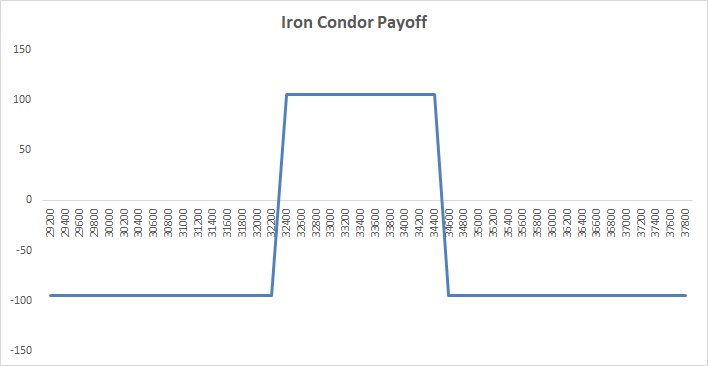

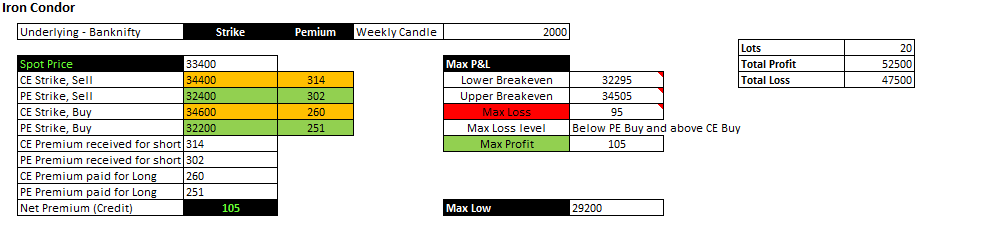

Suppose Banknifty ATM is 33400, then you can choose the following to create an Iron Condor.

- Short OTM Call option 34400 @ Rs.314

- Short OTM Put option 32400 @ Rs. 302

- Buy Further OTM Call option 34600 @ Rs. 260

- Buy Further OTM Put option 32200 @ Rs.251

Lets talk about P&L: When we sell Call and Put, we receive those premiums respectively, whereas when we buy Call and Put options we give premiums to the seller. Hence in this setup,

In this trade we have received premium of Rs.616 and paid premium of Rs. 511. Hence our total maximum earning can be 616-511= Rs. 105

If Banknifty closes between 32300 to 34500 then we are earning Rs.105 per 4 leg setup. So our earning is 105*25 = Rs. 2625.

You can choose many such combinations. i.e. to increase profit you can sell nearer OTM to get more premium and buy further OTM, however if you go further OTM your margin will increase as well.

Below is how the overall Iron Condor setup looks like.

If you want to trade on Iron condor strategies using automated Algo you can get in touch with us or click here.