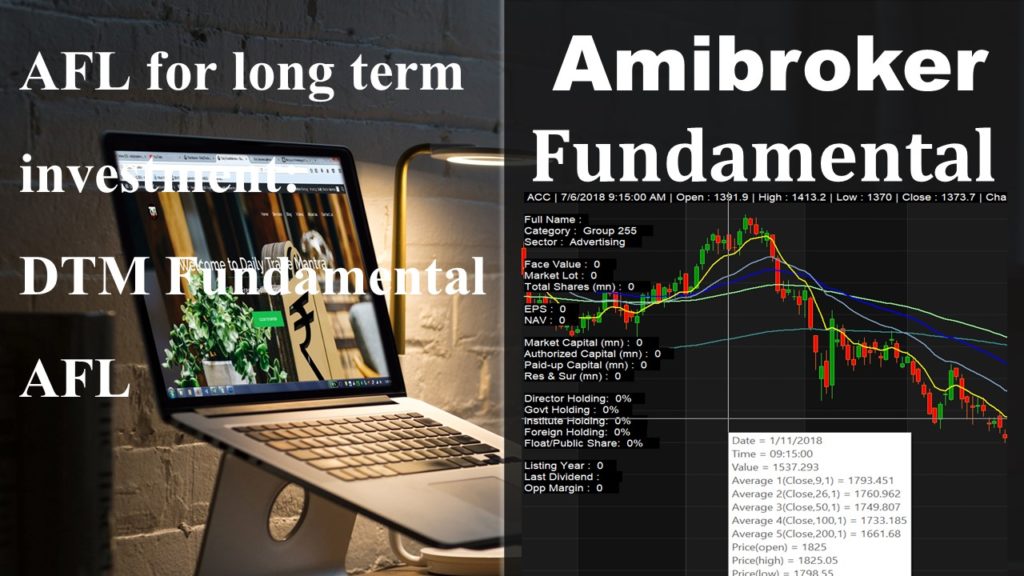

This is for all Investors, who want to develop their strategies to pick few fundamentally strong stocks based on few data points. Using Amibroker AFL we can get almost all fundamental data points i.e. “EPS”, “EPSEstCurrentYear”, “EPSEstNextYear”, “EPSEstNextQuarter”, “PEGRatio”, “SharesFloat”, “SharesOut”, “DividendPayDate”, “ExDividendDate”, “BookValuePerShare”, “DividendPerShare”, “ProfitMargin”, “OperatingMargin”, “OneYearTargetPrice”, “ReturnOnAssets”, “ReturnOnEquity”, “QtrlyRevenueGrowth”, “GrossProfitPerShare”, “SalesPerShare”, “EBITDAPerShare”, “QtrlyEarningsGrowth”, “InsiderHoldPercent”, “InstitutionHoldPercent”, “SharesShort”, “SharesShortPrevMonth”, “ForwardDividendPerShare”, “ForwardEPS”, “OperatingCashFlow”, “LeveredFreeCashFlow”, “Beta”, “LastSplitRatio”, “LastSplitDate”. However in this AFL I have covered few of them.

This AFL might help to build any strategy to buy a share based on some moving average crossover and fundamental data points. Moving Averages can be selected from the parameter and available averages are EMA, WMA, Liner regression, DEMA, TEMA, Wilders and Simple MA. By default 9, 26, 50, 100 and 200 EMA is plotted in this AFL. Please feel free to comment below for any queries you may have.