Writing this Blog on 20th March, when the total COVID-19 cases are 2,46,494. Of which recovered 88,485 and died 10,049. Currently infected cases are 1,47,960 and recovered cases are 88,485. courtesy worldometer.

India has active cases of 206 of which 5 cases of deth reported so far and we are in the 3rd stage of infection.

Yesterday PM Narendra Modi has addressed the nation on how can we face this biggest challenge of this decade rather the biggest threat of this century. He suggested all citizens to confined within our homes on Sunday the 22nd March as “Janta Curfew”, this is to ensure we can unite as a Nation to fight not only against Coronavirus but any such incidents at present and in future. He has also mentioned that there is Covid-19 taskforce that will draw up measures to combat the economic impact of this pandemic.

So far our Stock market has seen the damage of this Global Pendemic by witnessing 35% fall in 2 Months. NIFTY-50 opened at 12,430 on 20th January and after continuous crash of world economy NIFTY-50 faced a record low of 8,063 on 19th of March within 2 months of trading and effective 43 trading days. This is by far the biggest fall in a shortest time span in the history of NSE (If I am not wrong). The Index price is same as it was at the end of 2016. All gains of last 4 years are went in vain. But this is a good opportunity for investment for long term investor’s.

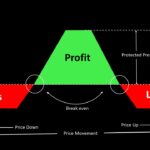

The question is will this continue or is this the new low and market will bounce back from this levels. Last two trading session shown this might be the base for a bounce back, but its not yet conclusive yet, as everything depends on the number of Active Coronavirus cases in India. If the count continues to be within control with the effect of the action PM Modi and his team is taking, then this surely be the temporary base, and we can see a bounce back. However no one can predict what can be the long term impact over world economy due to this Pandemic.